ANZ PROPERTY PROFILE REPORT

Request a Free ANZ Property Profile Report

Whether you’re buying your first home, upgrading to a larger home or an investment property, it’s important to know as much as possible about the property and the surrounding area.

Request Now ➤ Emailed By End of Day

ANZ Property Profile Report

Helping First Home Buyers to Veterans

Why Request a Free ANZ Property Profile Report?

Even for veteran home buyers, choosing and successfully bidding for a much-desired new property in a competitive market can be challenging. How daunting must the process be for first home buyers? Don’t feel overwhelmed. Take the worry out of the decision-making by working with an experienced Central Coast Mortgage Broker and a free ANZ Property Profile Report specifically tailored to the home in which you are interested, to help guide your residential property purchasing decisions.

Full-colour Photographs

An ANZ Property Profile Report provides you not only with those all-important numbers, but also with full-colour photographs (including an aerial view) to help you keep in mind and in perspective the visual appeal of both the property you have selected, and of those against which you should be comparing it, in terms of resale value.

Complex Data Modelling

Taking advantage of the complex data modelling and broad range of information contained in an ANZ Property Profile Report minimises the risks associated with purchasing a new home. It eliminates much of the uncertainty about the process by giving you access to comprehensive, timely and accurate facts and figures. For first home buyers, in particular, that represents real peace of mind.

A Better Way

There is more good news. By using a multifaceted ANZ Property Profile Report, not only do you not need to visit every open home and hear the sales pitch of every local real estate agent, but you also don’t have to be overloaded by reading and comparing tens or even hundreds of local property listings online.

Professional Broker Insight

Your Central Coast Mortgage Broker will help you interpret the data in an ANZ Property Profile Report that has been prepared individually for the property you have in mind, giving you the confidence to make your purchasing decision based on hard facts as well as on informed interpretations of local market trends. Your report will compare similar properties in the area, give you an overview of the local market and allow you to consider your chosen property in the appropriate context.

Automated Valuation Model

Powered by Hometrack, the ANZ Property Profile Report is underpinned by Hometrack’s Automated Valuation Model (AVM). The AVM is so powerful and reliable that it can often replace a physical valuation for a residential property, reducing costs for lenders. In addition to crunching the numbers, the report provides on-the-ground insights into the local area of the selected property. As well as information about services and facilities for shopping, education, sports and recreation, prospective purchasers have at their fingertips Australian Bureau of Statistics figures, by suburb/town and state, on age distribution and on home ownership vs rental properties in the area.

Price Prediction

Of course, the advertised price for a home and the final sale price often differ significantly, which can make setting and keeping to a budget difficult. An ANZ Property Profile Report provides a purchaser with a free up-to-date price prediction on the selected property, based on a proprietary algorithm developed by real estate website REALas and RMIT University. While these predictions are not the same as valuations, over the 12 months to August 2019 REALas reported predicting within 5.47% of the sale price, making them a valuable tool for both first home buyers and experienced purchasers. (In New South Wales REALas reported an even better result of 5.24% for the same 12-month period.)

Local Rental Income Data

Because not all properties are purchased for owner occupation, an ANZ Property Profile Report also includes listings of homes for rent in the local area of the selected property, with the advertised rents, where available. This information enables a prospective purchaser of a home for rent to compare their selected property with those against which it will compete for rental income. They can then work with their Central Coast Mortgage Broker to determine whether the home represents a sound addition to their investment property portfolio.

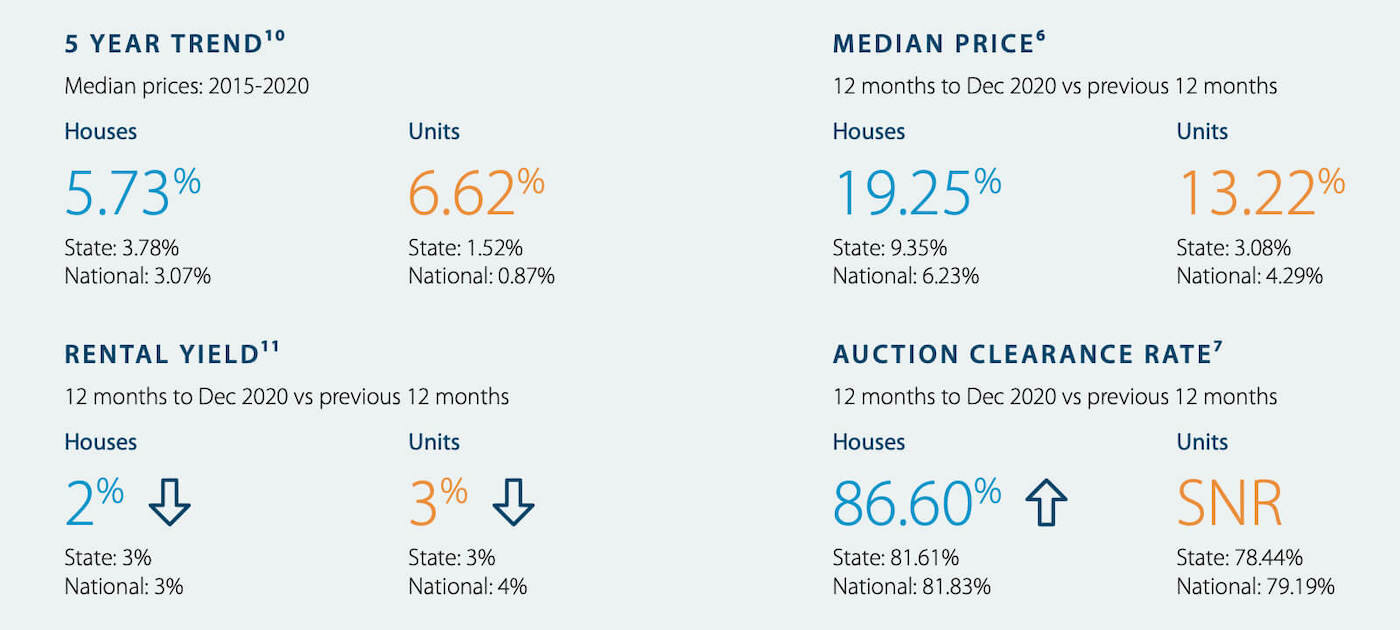

Local Market Snapshot

Each ANZ Property Profile Report includes a set of figures that creates a simple yet powerful snapshot of the property market for the location of the selected property. This section of the report answers questions that property purchasers should be asking about the local market. Your Central Coast Mortgage Broker will work with you to assess how the answers to these questions should influence your buying decision.

Collective Local Market Knowledge

Working with a free ANZ Property Profile Report on the home you want to purchase is like having the collective knowledge of the most experienced local real estate agents at your disposal, without having to inspect every property they have on their books, whether or not it interests you. Your Central Coast Mortgage Broker will help you to interpret the information in the report and to decide if you and the property are a good match financially. When it comes to making a bid for your new home to be, you’ll have done all the necessary preparation and can feel confident that you have based your decisions on sound, up-to-date information provided and assembled by experienced industry professionals.

Disclosing your information

By submitting this form, you agree to Horizon Mortgages:

Disclosing your information to RP Data Pty Ltd and Australian Property Monitors, and ANZ in relation to your Property Profile Report.

Contacting you by phone, SMS, or email to assist with any Home Loan needs.

Sharing your personal information with a third party for the purposes of planning and improving Horizon Mortgages products and services.

Any information collected by Horizon Mortgages will be handled in accordance with Horizon Mortgages Privacy Policy. Horizon Mortgages Privacy Policy also explains how you may access and seek correction of the information Horizon Mortgages holds about you or raise a concern about how Horizon Mortgages has handled your information.